Trading glossary

A glossary of terms and slang expressions used in stocks and crypto trading.

#Ask

An ask is an order listed on the sell-side of the order book.

#Bid

A bid is an order listed on the buy-side of the order book.

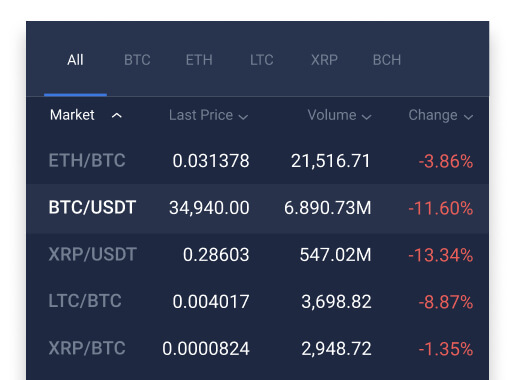

#Base Currency

The first currency in the currency pair is called the base currency. For example, the base currency in the currency pair BTC/EUR is BTC.

#Bear

A bear is an investor who bids on the market fall and may profit from a decline in stock prices. Bears are typically pessimistic about the state of a given market or underlying economy.

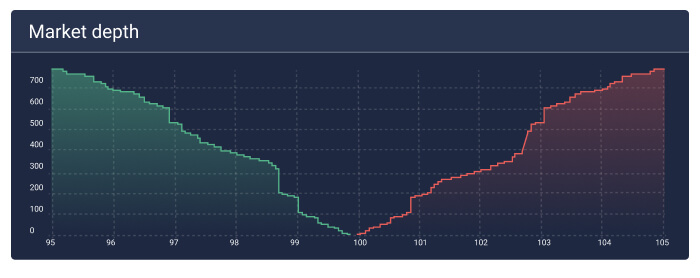

#Bid/Ask Depth

The Bid/Ask Depth represents the cumulative volume of buy and sell orders at a particular price. The bid depth at a given price is the cumulative volume of current buy orders on the book at that price or higher, while the ask depth at a given price is the cumulative volume of current sell orders on the book at that price or lower.

#Bid/Ask Spread

The difference in price between the highest bid and the lowest ask on the order book.

The bid/ask spread chart available for markets only shows the spread between the highest limit buy order and the lowest limit sell order (plotted over time). A market order will fill in this gap if there are matching market orders of the opposing type sufficient to fill it. Otherwise, it will load, at least in part, using limit orders of the opposite kind.

#Bull

A bull is an investor who bids on the market rise. Investors who adopt a bull approach buy stocks under the assumption that they can sell them later at a higher price. Bulls are optimistic investors who attempt to profit from stocks' upward movement, with specific strategies suited to that theory.

#Depth Chart

A depth chart is a visual representation of the demand and supply at different price levels. The bid/ask depth available for markets only shows the bid and ask depth of limit orders on the order book.

#Canceled Orders

A canceled order is withdrawn from the order book without being fulfilled. It will either remain unchanged or may be partially filled.

#Currency Pair

In a currency pair, you can see the base currency's value relative to the quote currency. The price indicates how much of the quote currency is required to buy one base currency unit. For example, a price of 10000 USD for BTC/USD means that you need 10000 USD to purchase 1 BTC. In currency pair trading, a pair can effectively be a single trading instrument opened as a position by buying (going long) or selling (going short).

#Collateral

To trade on margin, you need to have sufficient balance in one or more collateral currencies to back up your orders.

#Fiat Currency

Fiat is a government-issued currency acting as a legal trade tender, such as the US Dollar (USD), UK Pound Sterling (GBP), Euro (EUR), Japanese Yen (JPY), and others.

#Fill

To fill a buy or sell order is to execute the order by matching it with one or more orders of the opposing type. Buy orders match with sell orders and vice versa. Completed orders are referred to as 'filled.'

#Leverage

Leverage enables you to increase your exposure to the market without increasing your capital investment. For example, a collateral balance of 10,000 USD increases your buying power to 50,000 USD when trading on margin and using 5:1 leverage.

#Limit Order

A buy or sell order that will only execute at a pre-specified price.

#Liquidity

Liquidity is a term that describes the amount of activity in the given market. High liquidity means a high volume of trades in a market where many parties are willing to take the other side of a transaction.

#Maker

A "maker" is a trader who adds liquidity to the order book by placing a limit order that is not matched immediately with an existing order on the order book.

#Margin

When trading on margin, you are using borrowed funds to place orders instead of directly using the funds deposited or held in your exchange account.

#Margin Borrow Limit

The margin borrow limit defines the maximum amount of margin you can leverage for your particular currency orders. Regulations vary from exchange to exchange, and not all currency pairs can be traded on a margin. Usually, each currency limit is independent.

#Market Order

A market order will buy (or sell) at the best average market price.

#Minimum Order Size

Each tradable currency has a minimum order size. If you place an order below the minimum, it will be rejected.

#Open Order

Open orders can either be "touched" or "untouched." An "untouched" open order is an unfulfilled order. A "touched" open order is an order that is partially, but not wholly, filled. A filled order will be listed as closed.

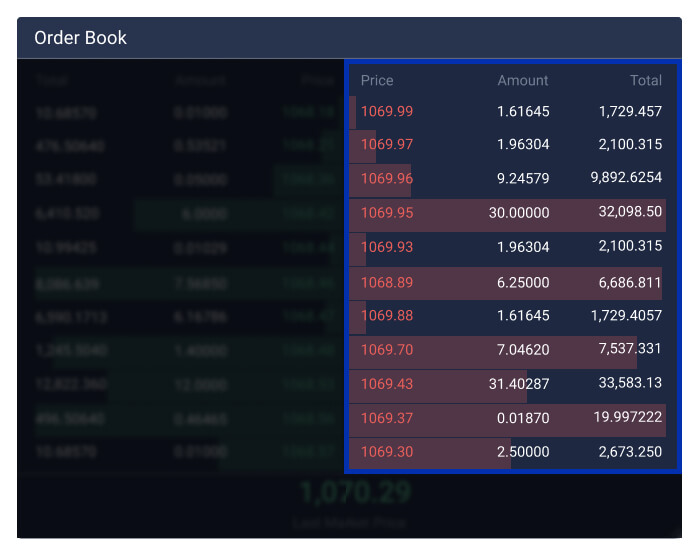

#Order Book

The order book is a list of current buy and sell orders used by an exchange to fill orders on a specific market. The order book consists of both orders to buy or sell at a fixed price ("limit" orders) and orders to buy or sell at the best available price ("market" orders). But since market orders only appear in the order book momentarily, they aren't shown in the publicly viewable order book.

#Quote Currency

The quote currency is the second of a currency pair. For example, in the currency pair XBT/USD, USD is the quote currency.

#Stop-loss Order

A Stop-loss order is a closing order to limit your losses or lock your profits on a long or short position. You can also use them to open a position.

#Take-profit Order

You can use take-profit orders to set a target profit price on a long or short position. You can define the desired profit as an absolute price or as a percentage. As with stop orders, take profit orders can also be used to open positions.

#Taker

A "taker" is a trader who removes liquidity from the order book by placing an immediately matched order with an existing order on the exchange order book.

#Volatility

A market's volatility is its likelihood of showing rapid and unpredictable price fluctuations.